The Financial Implications of Switching to Cloud Subscriptions

Imagine you need a car, but you’re not sure if you should rent or buy. How do you go about deciding? You most likely think about your current financial state, and what the spouse and kids will want. You also remember you want to go on vacation in the near future so it’s better to have more cash on hand. At this moment, you may decide to rent. Now mirror this example in a business setting.

You need to purchase software, but you’re not sure if you should rent or buy. How do you go about deciding? You think about what the business needs financially, what the board of directors and company shareholders expect to see on the company’s financial statements. You also remember that it was decided as a company to increase cash flow in the next three months. As a result, you decide to get the software on a subscription model.

Why is it important to consider the implications of transferring all software licenses to a subscription model?

The advances in cloud computing caused a shift in the consumption of software. End users are noticing the benefits of purchasing software on a subscription model as opposed to a license model. Some benefits include flexibility to “purchase as they go,” scale according to business needs, easy access to the software by multiple users, updates included in the price, and perceived cost savings.

Learn about VIZORTry VIZOR Online

Vendors, tech articles, and industry leaders remind us of these advantages all the time, but what seems to be removed from the narrative are the financial implications of switching from a license model to a subscription model. Depending on the board of directors, whether you’re a public or private company, the industry and even just the company goals, switching hundreds or even thousands of dollars worth of software to a subscription model may have significant effects on the financial statements, just like the example above.

Effects on your cash flow and balance sheet

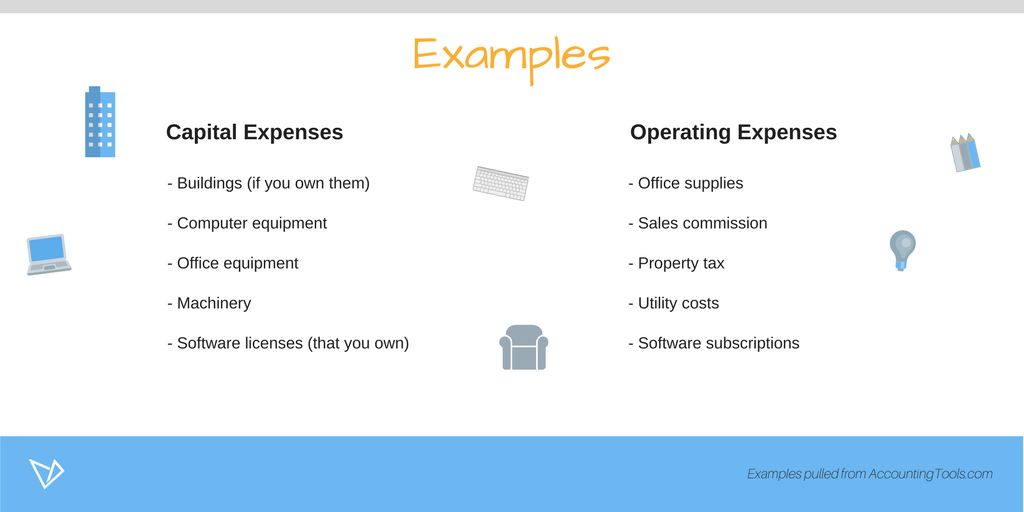

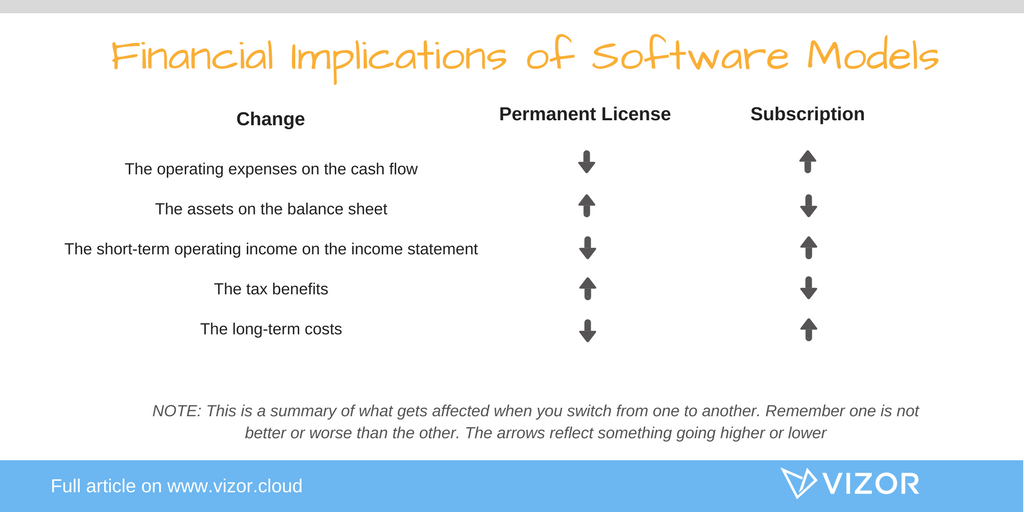

By switching to a subscription model, you are renting the software as opposed to owning it. Consequently, the capital expenses (long-term investments) go down and the operating expenses (ongoing costs) increase. This results in an increase in the cash flow. If it is important that the organization improves its cash flow position, subscription models can be the ideal choice.

In this case, however, a decrease in the capital expenses results in a decrease in the assets (what you own) on the balance sheet. The quantity & the value of the assets contributed to the organization’s equity. Therefore, the more assets, the more a business is worth. Thus, removing assets makes it look like the business is losing equity, or worth. This can look negative to shareholders who may be investing in the business, or to other stakeholders in the company.

The operating income (or earnings before interest and taxes) and the net income (earnings after taxes), will be affected by the Income Statement. In the operating income section, you subtract the operating expenses, depreciation, and amortization from the gross income. In the short term, you are removing the amortization of a permanent software license, which can be a significant amount. As a result, a subscription model is ideal if you want higher short-term operating expenses.

Effects of taxation

This depends on the industry of your organization and where the organization is geographically located. For example, in the USA, new tax code permits organizations to deduct all of their capital expenditures from their taxable income, immediately, as opposed to deducting it over a period of years. In other words, by investing in capital investments, you are eligible for tax benefits. It may be beneficial for a large corporation to consider this when purchasing thousands of dollars worth of software.

Finally, the overall cost of purchasing software as a subscription is usually more expensive long-term. Even though software licenses require maintenance upgrades, a subscription model includes updates in the monthly or yearly price, therefore, increasing the repeated fee. However, it might be more advantageous to be able to quickly switch from one software to another. Therefore, it may be worth paying more for the subscription model.

As you can see, there are several effects of changing to a subscription model. Ideally, the benefits of switching to a subscription model should be compared to the financial implications of making that change. Then, it should be aligned with the organization’s goals so the decision can contribute to the organization’s financial success. As a result, do not neglect the financial impact of switching. It might be the ongoing trend, but is it right for you?

What are your thoughts? Share with your manager!

Based on “Optimizing Financial Performance in Subscription Software Licensing” by Erick Yanez presented at the IT Financial Management Association show in Orlando 2018.

Need a IT Asset Management Tool?